Great Realtor Defined

What does buyer and seller needs this Real Estate Market….. |

| In this market a buyer and a seller needs a “Great” Realtor working for them.

What is “Great”… ~Experience-Knows the in’s and out’s and pitfalls to avoid ~Knowledgeable-Knows the market and the Laws ~Attentive-Will be there for you when you have questions or need to view properties ~Honest-Need I say more ~Caring-One whom really wants the best for you. ~Technically Savvy-Skills and resources at hand to find and deliver information to you at lightning speed ~Communicator-Will listen and hear your needs, wants, desires ~Patience-Work at client’s decision making pace ~Friendly-Nice to like the people that you associate with! Please feel free to contact me should you want to purchase a home investment in Las Vegas with a smooth, smart, and successful COE that will make you happy! Thanks much and have a great day! 702-355-H.o.m.e. [4663] |

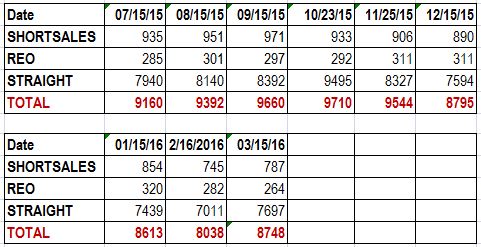

SnapShot of LV Market

SnapShot of the current market in Las Vegas today….

[What a buyer can expect]

![]()

Appreciation Map by Zipcode – JANUARY 2016

CLICK HERE to View Homes and Las Vegas Info

CLICK HERE to View Highrise Condos

Julia St. Marie, RRG, ABR, RSPS

![]() Phone: 702-355-H-O-M-E (4663)

Phone: 702-355-H-O-M-E (4663)

Email: Julia@LVRealEstateLady.com

My Testimonials

Dear Julia, I’ve written this recommendation of your work to share with other LinkedIn users. ———————————————————————— Details of the Recommendation: “Julia has represented me on over ten transactions; she has been timely, direct, and of high integrity. She has always done what we’ve agreed and has been a great partner in supporting RE Group, LLC.”

“Julia, Thank you for helping us purchase our very first home as newlyweds! We didn’t know the first thing about real estate transactions but you really made the process of buying a home fun, quick and easy for us. Thank you again!” Love always, Lina & Ryo

“Hi Julia, The services you rendered were very helpful. Purchasing realestate from out of the area can be very scary, but you were always there making sure everything went ok. From the purchasing of the property to the closing you were right on top of things. You were superb!!!” Good luck, AL

“Dear Julia, As someone moving across country to Las Vegas, Nevada, with a pregnant wife and small child, Julia made us her first priority. From keeping in touch with us via email and cell phone to picking us up at our hotel when we were in town, my wife and I were objectively and well informed about the properties we viewed before eventually choosing our new home. And, even after signing the purchase contract, Julia continued to work for us until after escrow had closed. She is professional, motivated and genuine. I have not hesitated to refer her to our friends and my clients, and we will certainly seek her services again in future.” James Harper, Esq.

“Hi, Julia! Time has flown! Thanks for everything. We enjoyed the condo for a couple of months and now have a nice young family living there. Tony and I both would like to personally thank you for all of your help. You opened our eyes to properties we would not have found. You were a great source of information for us and helped to walk us through it. On top of that, you were always in communication with the sellers and the bank and myself. We really appreciate all your help. Thanks for everything! Take care and talk to you soon!” Elana

“Hi Julia,

We really appreciated your attentiveness in all aspects of the purchase of our home. You simplified the process and put us at ease with your knowledge and expertise in real estate and the Las Vegas marketplace. You were always accessible to answer any questions or concerns. We would not hesitate to recommend you as a Real Estate Professional. Thanks again!” Christina and Mark Velez

“Julia St. Marie sold several investment properties for me during a time when the Las Vegas market was saturated with investor sales and in a location where there was much competition. I got a good price for my houses, even with all that competition. Julia was truly a full-service realtor in that her goal was to minimize the work and worrying I had to do. She used several means for advertising, some of which went beyond what I had previously experienced, and she coordinated the whole process for me. Julia is a true professional with an exceptionally colorful personality, and I was very satisfied with her services and results. I highly recommend her to anyone.” Mike Lugo

“Dear Julie,

I just wanted to thank you for all your hard work. I know I was probably one of your difficult clients to make happy but you succeeded. I am quite picky and indecisive at times and you were able to help me make all the right choices and decisions.

I was very happy with the outcome of the sale of my home and am very happy with my new home that we chose together. The neighborhood is great and the builder is exceptional.

When I am ready to sell and buy again I will call you. I am thinking of upgrading one more time before my son starts high school which will be August 2007. I will call you when I am ready to make a move again. Thanks again.”

Sincerely yours, Carol J. Hibbard

“Julia,

Thank you so much, you have gone way beyond the call of duty and it is greatly appreciated. I haven’t contacted Jeanne yet (Property Manager) but will it the next day or so, and as soon as I do, you can pass keys to her, I will have her make an additional set for me. Your service has been impeccable, couldn’t have done any of this without you! Elizabeth”

Julia St. Marie, RRG, ABR, RSPS — Phone: 702-355-H-O-M-E (4663)

www.LVRealEstateLady.com

CLICK HERE TO SEE HUNDREDS OF HIGHRISE CONDOS ON AND ADJACENT TO THE LAS VEGAS STRIP

1031 Exchange

What is Tax-Deferred 1031 Exchange?

Under Section 1031 of the Internal Revenue Code, owners of real estate held for investment or use in a trade or business can swap their property tax-free for “like-kind” real estate. Exchanges are made for people wanting to stay invested in real estate, increase their leverage and to avoid paying hefty taxes upon the sale of property.

With the on set of the current appreciation that Las Vegas has realized and gaining, 1031 Exchange are a worthy, viable, and smart instrument for the savvy seller.

“Like Kind”

– Apartments

– Rental Houses

– Retail Properties

– Commercial

– Raw Land

– Office Buildings

– Industrial

– Ranches

Non Qualifying Properties

– Personal Residences

– Dealer Property

– Partnership Interests

– Inventory

Reason to Exchanges

– Restoring Depreciation that will soon expire – by exchanging one property for another of greater value.

– To upgrade size and/or quality of investment. An exchange can be utilized to combine the equity of one or more properties into a larger singular investment.

– To change investment location. An exchange can be executed in anticipation of market trends to maximize appreciation potential.

7 Steps for a Successful 1031 Tax Deferred Exchange

Step 1: Consult with your tax and financial advisors to determine if a tax deferred exchange is appropriate for your circumstances and compatible with your investment goals.

Step 2: Listing the Relinquished Property for sale with Julia St.Marie at Realty ONE Group [Referred to as a licensed real estate agent] During the first step the Exchanger will list the Relinquished Property with a real estate agent. The broker/agent will disclose the intent to complete an exchange in the listing agreement.

Step 3: Offer, Counter Offer and Acceptance. The Exchanger enters into a contract with the Buyer for the sale/exchange of the Relinquished Property. The broker/agent discloses the Seller/Exchanger’s intent to exchange into the Purchase Agreement and Receipt for Deposit.

Step 4: Open escrow for the Relinquished Property and coordinate with the Facilitator. The Facilitator prepares the exchange agreement and coordinates with the escrow holder to close escrow as Phase I of a tax deferred exchange. Important: The exchange agreement must be in place and signed by all parties prior to close of escrow. Additionally, all earnest money deposits should be placed with the title company.

Step 5: Replacement Property Identification. After closing escrow for the sale of the Relinquished Property, the Exchanger must identify all Replacement Property within 45 days from day after close of escrow.

Step 6: Contracting for the Replacement Property. After closing on the Relinquished Property the Exchanger has 180 days to acquire the Replacement Property. With the help of Real Estate Agent, the Exchanger enters into contract to purchase the Replacement Property from the Seller. In the contract to purchase the agent discloses the Exchanger’s intent to complete the exchange and obtains the Seller’s cooperation.

Step 7: Open escrow for the Replacement Property. The Facilitator prepares the Phase II Exchange Agreement and coordinates with the Replacement Property Escrow holder. The funds held in trust by the Facilitator are placed in escrow and the Replacement Property is purchased by the Facilitator from the seller. The Facilitator then transfers the Replacement Property to the Exchanger and the transaction is closed as Phase II of a delayed exchange.

Identification of Replacement Property

Regardless of the number of relinquished properties transferred by the Exchanger as part of the same exchange, the maximum number of replacement properties that the Exchanger can identify is as follows:

3 Property Rule: Three properties without regard to the fair market values of the replacement properties.

Or

200 Percent Rule: Any number of properties as long as their aggregate fair market value as of the end of the identification period does not exceed 200 percent of the aggregate fair market value of all the relinquished properties as of the date the relinquished properties were transferred by the Exchanger.

Exception

95 Percent Rule: Any number of replacement properties identified before the end of the identification period and received before the end of the exchange period, but only if the Exchanger receives before the end of the exchange period identified replacement property the fair market value of which is at least 95 percent of the aggregate fair market value of all identified replacement properties.

Glossary of Terms

Accommodator: A principal involved in the exchange transaction who agrees to assist the exchanger to effect a tax-deferred exchange. Same as Facilitator or intermediary.

Accommodating Party: In an exchange of properties there is always a person or entity that steps in to accommodate or facilitate the exchange transaction. Depending on how the transaction is structured, the accommodating party may incur additional liability in their efforts to assist in the exchange.

Acquisition Property: Replacement property

Actual Receipt: When the Exchanger actually receives the funds from the sale of the Relinquished Property. Receipt of cash by the Exchanger before he receives the Replacement Property may be enough to destroy the tax deferred treatment of the transaction.

Adjusted Basis: Generally speaking the adjusted basis is equal to the purchase price plus capital improvements less depreciation. Transactions involving exchanges, gifts, probates and receiving property from a trust can have an impact on calculating the property’s adjusted basis. The taxpayer’s C.P.A. or tax advisor is the party to look to for these types of questions.

Boot: Boot is any type of property received or given up in an exchange that does not meet the like kind requirement. Generally speaking, receiving boot will trigger the recognition of gain and taxes. If the Exchanger receives boot, they will be taxed. Boot added or given up by the Exchanger does not necessarily trigger a taxable event. In a real property exchange, boot received is any type of property received by the exchange which is not real property held for investment or productive use in a trade or business.

Cash Boot: Cash Boot consists of cash and non-qualifying property. A car, a boat or receipt of the beneficial interest in a promissory note are all examples of Cash Boot.

Mortgage Boot: Mortgage Boot consists of the secured debt given up and received as part of the same exchange. If the exchanger increases the amount of debt on the Replacement Property verses the Relinquished Property, they have given mortgage boot. If the exchanger decreases the amount of debt on the Replacement Property verses the Relinquished Property, they have received mortgage boot. Generally speaking, mortgage boot received triggers the recognition of gain and it is taxable, unless offset by Cash Boot added or given up in the exchange.

Constructive Receipt: Even if the Exchanger does not actually receive the proceeds from the disposition of the Relinquished Property, the exchange will be disallowed if the Exchanger is treated as having constructively received the funds.

Delayed Exchange: Also called non-simultaneous, deferred and Starker. A delayed exchange is a tax deferred exchange where the Replacement Property is Received after the transfer of the Relinquished Property. In a delayed exchange the Exchanger must identify all potential Replacement Properties within 45 days from the transfer of the Relinquished Property and the Exchanger must receive all Replacement Properties within 180 days or the due date of the Exchanger’s tax return whichever occurs first.

Like-Kind Property: Refers to the nature of the property the Exchanger gives up or receives as part of the same tax deferred exchange transaction. In order to qualify as like kind the property given up or received must be held for productive use in a trade or business or held for investment to qualify as like-kind.

Realized Gain: Refers to a gain that is not necessarily taxed. In a successful exchange the gain is realized but not recognized and therefore not taxed.

Recognized Gain: Refers to gain which is subject to tax. When someone disposes of property at a gain or profit in a taxable transfer such as a sale, the gain is not only realized, but recognized and subject to tax.

Relinquished Property: The property given up by the exchange to start the 1031 exchange transaction. This property usually passes through an accommodator before transferring to the ultimate Buyer.

Reverse Exchange: An exchange where the Exchange acquires or gains control of the Replacement Property before disposing of the Relinquished Property.

Simultaneous Exchange: Also referred to as a concurrent exchange. A simultaneous exchange is an exchange transaction where the Exchanger transfers out of the Relinquished Property and Receives the Replacement Property at the same time.

Transfer Tax: A tax usually assessed by a city or county on the transfer of property. It may be based on equity or value. When structuring a multi-party exchange an exchange agreement will usually call for direct deeding to eliminate additional transfer tax.

BELOW PLEASE FIND 1031 FACILITATORS:

Starker Services, Inc.

National Exchange Intermediary

http://www.starker.com

Kandas Myer-Regional Manager

775-721-4190/800-280-1031/775-322-8487/ KandasMyer@gmail.com

500 N. Rainbow Blvd. #300, Las Vegas, NV 89107

Old Republic Exchange Company

OREXCO

http://www.orexco1031.com

Old Republic Title Company of Nevada

8861 West Sahara Avenue, Suite 110 , Las Vegas, NV 89117

Phone: (702) 362-0212/Fax: (702) 737-6440

Please be informed that the above-mentioned are references for your convenience should you choose to use them. If not, please feel free to consult your local Yellow Pages.

![]()

Julia St. Marie, ABR, RRG, RSPS

702-355-H.o.m.e. [4663]

![]()

VIEW DETACHED HOMES: http://www.LVRealEstateLady.com

VIEW CONDO HIGHRISE and MIDRISE: http://www.LasVegasCondoHeaven.com

Homes By Zipcode

LAS VEGAS and HENDERSON DETACHED HOMES BY ZIP CODES —

If you need a zipcode map, please click here>> “Zipcode and Area Map”

Southwest – Las Vegas

Southeast -Las Vegas and Henderson

89044 89183 89052 89123 89012 89074 89002 89015 89011 89122 89121 89169 89109

Northwest-Las Vegas

North – Las Vegas

Northeast – Las Vegas

To View One of these Lovely Residences

Julia St. Marie, ABR, RRG, RSPS

702-355-H.o.m.e. [4663]

VIEW DETACHED HOMES: http://www.LVRealEstateLady.com

VIEW CONDO HIGHRISE and MIDRISE: http://www.LasVegasCondoHeaven.com

*************************************

To View Las Vegas Market Updates, Trends, Information

Attentive, Knowledgeable, Honest and Caring

203K Renovation Loan Program

Use the 203K Renovation Loan Program to help find and have your dream home!

The home that you want and the way you want it to be!

> Buyer just needs to focus on floor plan and location.

>If what you have to choose from is not in the condition you prefer, no problem!

> You may customize the outdated or damaged home to your preference with the 203K Renovation Loan Program.

What can you expect?

>Competitive Rates

>3.5% Down Payment available

>Move-In Condition House Includes NEW: Roof, flooring, plumbing, fixtures, electrical, HVAC, Cabinets, Paint, Windows, Appliances, landscaping, non-structural repairs.

>Up to $35,000 for these repairs may be financed into your 203K Renovation Loan!

Take a look BEFORE and AFTER!!!

Contact me to help you get started on Purchasing a Home the way you want it!

![]() Julia St. Marie, ABR, RRG, RSPS –Certified REO Specialist

Julia St. Marie, ABR, RRG, RSPS –Certified REO Specialist

702-355-H.o.m.e. [4663]

![]() LVRealEstateLady@yahoo.com

LVRealEstateLady@yahoo.com

Las Vegas-203K Renovation Loan Program

“Have it your Way!”

Is It A Safe Area

RE: Safe Area: To help you answer the question…..Is this a safe area?

The best way for me to answer this question is to be “The source of the source.”

> Go to the LV Metropolitan Police website > CLICK HERE

> Go to the PROTECT YOURSELF TAB at the top of the page

> Use the Pull Down Menu and go to CRIME MAPPING

> You are ready now to put in the address or ZIP CODE in the SEARCH BAR on top of page

Julia St. Marie, ABR, RRG, RSPS

702-355-H.o.m.e. [4663]

LVRealEstateLady@Yahoo.com

“OverLap” Retirement Plan

For years I have been helping clients whom plan to retire in Las Vegas with the “Over Lap” Retirement Plan.

You see there are many people whom currently own and reside in high priced states….such as California, New York, and Hawaii, just to name a few. They have some savings; whereas they may purchase a retirement home in Las Vegas while holding on to their current home.

The reasons are simple….hence the “Over Lap” Retirement Plan works…

Home #1–Residing in now Home # 2–Residing and retiring in later

1. Las Vegas Homes are so low priced that many have savings to well enough to afford a purchase of Las Vegas Home #2 for their future retirement.

2. Home #1 is much higher priced than Home #2 the Las Vegas acquisition. Whereas when this current economic cycle ends, Home #1 will sell at even a higher price than now. The sale of home #1 is then put back in the kitty whereby replenishing their retirement savings account.

3. While planning for this transition, many soon to be retirees are enjoying Las Vegas Home #2 as a second vacation home.

Although financial sense is a motivation for the “Over Lap” Retirement Plan, there are some there other motivating factors….

1. The Weather in Las Vegas seems to be easier on the joints than from the much colder areas.

2. People get tired of the harsh snow conditions of shoveling snow, getting stuck, being inconvenienced, having to stay indoors, and dealing with all the pitfalls of cold weather conditions.

3. Las Vegas does not have State Income tax. Although when you retire you may be in a lower tax bracket, no state tax does comes in handy as every little bit can help.

3. Las Vegas has a lot to offer seniors. Some do enjoy the casino recreation such as Bingo, Slots, and Card playing.

4. The Las Vegas Age-restricted communities have a bountiful of activities for its members along with pool, spa, golf, tennis amenities, and social events.

5. For those whom like to dine out, Las Vegas does offer the finest restaurants on and off the Strip.

6. Las Vegas is such an attractive destination, that retirees are assured that they will have an exciting and fun-filled environment for visiting families.

Below please find just a few Age-Restricted Communities – Active Adult [55+] that you will find in Las Vegas.

SUN CITY SUMMERLIN — Sun City Summerlin is located Summerlin in the Northwest Area of Las Vegas. There are 3,470 homes on 2,400 acres in Sun City Summerlin ranging from 1020-4050 Square Feet. Community Amenities Include: Community Golf, Miniature Golf, Racquetball Court, Recreation Room, Tennis, Gym, 3 Outdoor Pools, 2 Indoor Pools, 4 community centers, and Spa.

My father lives in Sun City Summerlin and here is where he found the love of his life and is very happy.

CLICK ON THE IMAGE OF Sun City Golf Courses TO SEE HOMES THAT ARE NOW AVAILABLE IN SUN CITY SUMMERLIN

SUN CITY ALIANTE—Sun City Aliante is located in Aliante North Las Vegas area. It is north and within close proximity of the I215. It is residential, clean, pride of ownership, and complete amenities. The Community Amenities Include: Golf, Recreation Room, Clubhouse, Gym, Pool, Spa, and Tennis.

Aliante is home to the Aliante Station Casino. Locals do enjoy the many restaurants, buffets, lounges, movie theatres, and recreational bingo, slots, and card playing.

Sun City Aliante has homes ranging from 1157-2104 SqFt.

CLICK ON THE IMAGE OF Aliante Station Casino TO SEE HOMES THAT ARE NOW AVAILABLE IN SUN CITY ALIANTE.

SUN CITY ANTHEM—Sun City Anthem is one of the largest age restricted communities in the Las Vegas with approximately 7500 homes.

Amenities include the community centers, 2 golf courses, tennis courts, bocce ball, pickle ball, paddle ball, indoor and outdoor pools, state-of-the-art fitness equipment, security, community television station channel 99 and an on- site restaurant.

Homes range from 1,442 sq. ft. to 3175 sq. ft.

Sun City Anthem is rated #1 in 55Places.com’s list of its ‘10 favorite luxurious active adult communities in the United States.’

Here is a link to Sun City Anthem Hoa—>>https://sca-hoa.org.

CLICK ON THE IMAGE OF Sun City Anthem Security Patrol TO VIEW HOMES THAT ARE CURRENTLY AVAILABLE IN SUN CITY ANTHEM.

SOLERA AT STALLION MOUNTAIN—Las Vegas-Stallion Mountain is the lowest Priced Guard Gated-Golf Course Community in Las Vegas!

Stallion Mountain is a Guard Gated-Golf Course community located in the East just east of Boulder Highway and off of Flamingo. It is 5 miles from the Las Vegas Strip and within close proximity to McCarran Airport.

The homes are approximately 1150sf t 2800sf. Some homes have pools and some have pool size backyards and some homes have a golf course view. You will find well built Pulte homes in Stallion Mountain. You will find one story homes in the Age-restricted community in Stallion Mountain called Solera.

CLICK ON THE IMAGE OF THE Stallion Mountain Golf Course TO VIEW HOMES THAT ARE CURRENTLY AVAILABLE IN SOLERA AT STALLION MOUNTAIN.

Stallion Mountain has the lowest price homes that are within a Guard Gated – Golf Course Community. Stallion Mountain a TRUE VALUE.

If you would like to find out more about the wonderful Age-Restricted Communities located in Las Vegas, why not contact me and I shall be happy to assist.

Julia St. Marie, ABR, RRG, RSPS

702-355-H.o.m.e. [4663]

LVRealEstateLady@yahoo.com

click

click